Table of Content

You may also need to pay to get certain business licenses in the state. Starting a business in Michigan is exciting but requires establishing the right entity, getting your financials in order and securing the perfect location. Forming a business entity doesn’t cost a lot, making it easy to start your business.

Our home health care consultants are dedicated to supporting you with overcoming the challenges and obstacles you may encounter when operating a successful home health care business. With this in mind, running a successful home health care business depends on having all the building blocks. Our home health care consultants are committed to helping you establish your business while increasing recognition in your market area. Our coaches will assist you with understanding the requirements for your home health business. Michigan has seen an increase in emerging small businesses and a decrease in the unemployment rate, making it worthwhile to start a business here.

Home Health Care Training and Clinical Support

The pressure-sensitive adhesive, custom ordered from 3M, simplifies the process of application and respects your device, leaving no residue upon removal. Each product can be applied and reapplied multiple times to the same or similar devices. My name is Jesse Hambly, I’m 1 of 3 brothers working at Pressa Inc. We have a diverse background, Luke manages engineering and manufacturing duties. Mason is in charge of media, content creation and strategy, and I oversee marketing, operations, and customer relations.

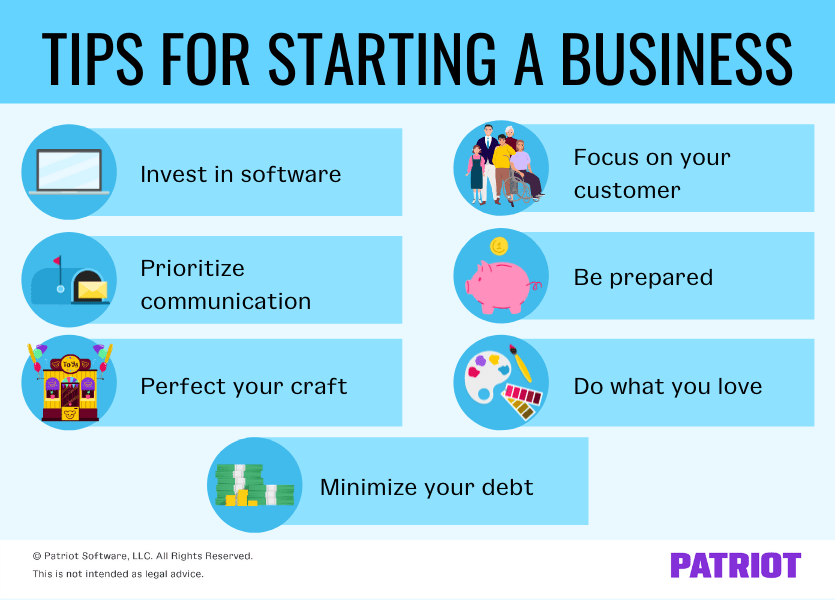

If you have questions, have a business or real estate attorney read through and advise you on the agreement. Build genuine relationships with customers that keeps them coming back—and spreading the word to friends, family, and colleagues. Choose a business name, abiding by any rules specific to the structure you’ve chosen.

Write a Business Plan

Next, be smart with your spending and get organized by creating a detailed financial plan. Doing your research on Michigan’s popular areas such asDetroitorAnn Arborcan help increase foot traffic and drive customer interest. A Corporation is a very formal business structure with unlimited shareholders. The business is authorized to act as a single entity and is recognized as such in law.

A Corporation is also considered a separate legal entity from its owners. Its owners are referred to as shareholders and are issued stock in the Corporation, proportional to their ownership interest. Corporations enjoy a great deal of liability protection, but they are subject to higher taxes than other business structures. Under the typical C-Corporation tax status, Corporations are subject to “double-taxation”. This is because a Corporation must first pay tax on their profits at the corporate tax rate, after which they can distribute earnings to shareholders who in turn will also pay taxes. Our new home health care business startup process includes all required policy and procedure manuals.

Resources for Your Michigan Business

If you want to bill Medicare, your home health care agency must be just that, a health care agency providing skilled nursing services. Medicare does not apply to non-medical home care and a home care agency is not able to bill Medicare. If you would like to start a home health care agency in Michigan and bill Medicare, you will need to achieve Medicare Certification and Accreditation. Here are some of the home care and home health care businesses, as well as other businesses models Certified Homecare Consulting can help you start in Michigan. With so many requirements to open and run a home care business in Michigan its no surprise why so many people choose Certified Homecare Consulting. At Certified Homecare Consulting we give you the tools for success!

Google My Business is a helpful tool that allows businesses to manage how their business appears on Google’s search engine results page and Google maps. Last but not least, try ourFree Logo Generator to get a unique logo for your business in Michigan. Our logo maker is free (no sign-ups or email address needed) and it comes in all social media sizes. Or, if you want to explore your options, you can also use this free logo maker by Tailor Brands.

If you want to do business under a name different from your business’s true and legal name, you should file a DBA. However, if you want to do business under a name other than the business’s legal name, you should file a DBA name. A Michigan LLC is a hybrid business entity that combines the benefits of a Corporation and a Sole Proprietorship or Partnership.

Below are links to our core resource guides that can introduce you to some savvy tools and insight if you’re not already familiar. You can also check out our comprehensive list of business resources. You can use your own personal savings, borrow money from friends or family, obtain a small business loan from a bank or other lending institution, raise money from investors, and more. Press releases are a great way to communicate important information about your Michigan business to media outlets and potential clients. Professional Liability Insurance — this is typically used by business service providers such as accountants or consultants to protect you in the event of malpractice claims or other business errors. When your personal and business accounts are mixed, your personal assets are at risk in the event someone sues your business.

You may want to consult a tax advisor and business lawyer to make sure that you choose the entity that provides you with the best tax advantages and liability protection for your business. Your Michigan business must acquire the necessary business licenses to run lawfully in the state. The state runs a database of licenses you can search prior to applying. If your business owns buildings or land, you’ll need to pay property tax at the county level, though tax rates vary from county to county. In Detroit, for example, as an LLC owner, you’ll need to pay individual income tax to the city at a rate of 2.4%. Registered business entities like LLCs and corporations start out with a default tax status, but can file paperwork with the IRS to be taxed as an S-Corp.

Doing business in Michigan, you’ll need to pay federal, state, and, in some cases, local taxes. Michigan also charges sales tax on tangible personal property, so depending on what kind of business you’re in, you may need to factor this into your prices. Compared to other states, Michigan’s tax rates run average or a little higher than average.

Sole proprietorship owners are required to include their name in the business name. If you wish to carry out your business under a name different from the legal name, you will have to register for a Michigan Assumed Name. Once complete, you should use the information you’ve collected to draft a business plan. Creating a business plan is a crucial step, so you’ll want to fight the urge to skip it.

An EIN Number will also be used to open a business bank account. Sole Proprietorships and Partnerships in Michigan file DBAs at the county level. You’ll need to contact the county where you’re doing business to check on their filing requirements. If you’re starting an LLC or Corporation, you’ll also need to choose a Registered Agent. LLCs are also a lot easier to set up and maintain than Corporations.

No comments:

Post a Comment